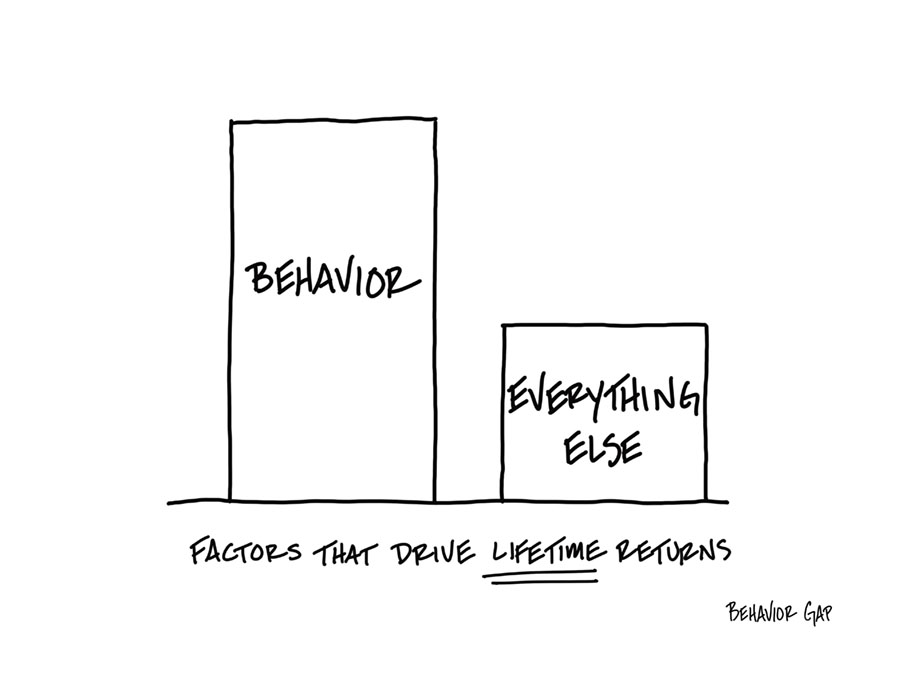

Behavior versus everything else

Lifetime? I like the sound of that

There are a lot of people out there making a lot of noise and waving their hands, trying to tell you what you should be focusing on as an investor.

These “hand-wavey” people talk about China, things like The Fed, monetary policy, stimulus, asset allocation, and shiny objects like silver and gold. It’s an awful lot to keep track of.

And don’t get me wrong, some of those things actually do matter. It’s not a bad idea to learn about them.

But one thing is certain: When it comes to investing, nothing matters anywhere near as much as your behavior.

You can design the greatest portfolio ever created by humankind, and one behavioral mistake a decade could mean you would’ve been better off in CDs at your bank or stuffing the cash in your mattress.

So yes, the economy matters, smart portfolio design matters, how much we have in small cap, value, and growth—all those things matter.

But the thing that matters most is having investments that will allow you to behave.

In fact, I would argue that even portfolio design only matters to the degree that it influences good behavior.

Arguing over whether you should have 17.2% or 17.5% in emerging markets—that might be an interesting debate, but the difference between 17.2 and 17.5 is a misdemeanor when the felony we’re all committing is behaving poorly.

So next time a “hand-wavey” person shows up in your face telling you all the things you should be doing, just smile, nod, and walk away.

And remember that none of it matters if you don’t know how to behave.

Be Brave and Be Kind

Browse More

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

You Won’t Believe This Figure!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Why is Medicare so confusing?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

BBK Wealth Perspective – What is stress testing?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.